Farm Loan Calculator

Calculate the monthly loan payment on a farm loan.

Calculate a Farm Loan Payment

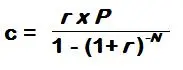

To calculate the monthly payment on a farm loan use the formula:

c = Monthly Payment

r = Monthly Interest Rate (in Decimal Form) =

(Yearly Interest Rate/100) / 12

P = Principal Amount on the Loan

N = Total # of Months for the loan ( Years on the loan x 12)

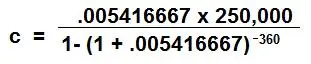

Example: Monthly loan payment for 30 year fixed-rate loan,

with a

principal of $250,000, and a yearly interest rate of 6.5%:

r = (6.5 / 100) / 12 = .005416667

P = 250,000

N = (30 x 12) = 360

The Monthly Loan Payment is $1580.17

Questions to ask yourself or the loan advisor when looking into financing a farm loan?

Whether you are just starting out as a farmer, or making your way in the farming industry, there are times when you might need to borrow money! Before diving head first

it’s always good to have an idea of what those payments might look like with our farm loan calculator and what information you'll need while applying for a farm loan.

(It’s important to remember specific interest rates will be dependent on the market as well as your credit).

What are some questions to ask yourself or the loan advisor when looking into financing a farm loan?

Who provides farm loans?

USDA’s Farm Service Agency (FSA) loans provide access to capital in order for them to grow or start a farming operation, pay for large equipment and storage as well as help with cash flow needs.

What are you looking to buy or lease property or large equipment?

Do you already own land, and want to expand? Or are you starting fresh?

What if I am new to the farming industry?

The commitment of growing a financially successful farm is a daunting financial investment, especially for farmers at the start. FSA programs are important as beginning farmers,

historically have experienced more pitfalls obtaining financial assistance. Unlike loans from a commercial lender, FSA loans are temporary, with the goal of helping you graduate

to commercial credit.

What are the qualifications for a beginning farmer as an individual or entity who:

- 1. Has not operated a farm for more than 10 years;

- 2. Substantially participates in the operation;

- 3. For farm ownership loans, the applicant cannot own a farm greater than 30 percent of the average size farm in the county, at time of application.

- 4. If the applicant is an entity, all members must be related by blood or marriage, and all entity members must be eligible beginning farmers. In addition, beginning farmers must meet the loan eligibility requirements for the program.

Frequently asked questions and questions to ask when considering a farm loan:

What qualifications do I need to meet to be approved for a farm loan?

What is the application process for farm loans?

What documents are needed before applying for a farm or ag loan?

What qualification am I looking for in a farm loan?

What am I allowed to spend this capital on?

What type of loan am I looking to acquire?

1. Farm Ownership loans: Financing new land or enlarge a piece of property, help finance construction for a new building or improve

an existing farm or ranch structure, as well as helping pay for soil and water conservation and protection.

2. Operating loans: For the purchase of livestock, minor property repairs and annual operating expenses.

3. Microloans & EZ Guarantee loans: Financing for direct farm ownership and operating loans with a shortened application process.

4. Emergency loans: Financing for a qualifying loss caused by natural disasters that damaged your farm or ranch.

5. Conservation loans: Financing for an approved conservation plan.

6. Land contract guarantees: Financing with extra guarantees to the seller of a farm through a land contract sale.

7. Highly Fractionated Indian Land Loans: Financing for tribes, tribal members, and tribal entities to purchase fractionated interests through intermediary lenders.

Do you need a business plan before applying?

YES, this is the core plan of what you will be doing with the money given.

What are some important features in your farm loan business plan?

The roadmap of where you started, where you are now and where you plan to be in the future.

Description of your financial and operational goals, as well as evaluation of your business progress, and how your plan to move forward with your goals in the future.

Your mission, vision and goals.

Current assets and liabilities.

Marketing Plan: What you will produce, where and how you will sell it.

What are the current interest rates?

Interest rates for Operating and Ownership loans for June 2022 are as follows:

Farm Operating Loans (Direct): 3.625%

Farm Ownership Loans (Direct): 3.750%

Farm Ownership Loans (Direct, Joint Financing): 2.500%

Farm Ownership Loans (Down Payment): 1.500%

Emergency Loan (Amount of Actual Loss): 3.750 %

What are the loan eligibility requirements for the program that best fits you?

What are the other factors when determining the cost of a loan?

Credit Score

Down payment

Loan Term

Loan Type

How do interest rates affect the cost of a loan?

Interest rates have a profound impact on the agriculture industry because it directly correlates to the value of farm land, and other potential investment decisions.

Make sure you keep in mind that interest rates will and can change and fluctuate with the market over time after fixed period.

I've applied, now what’s next?

If your direct loan is approved, FSA will notify you in writing of:

the approved use of loan funds

the interest rate

the timeline of the loan

the collateral that you will have to pledge to secure the loan

when the money is expected to be accessible

any pre-loan closing requirements

your responsibilities as an FSA direct loan borrower

If your direct loan is not approved, FSA will notify you in writing of:

The reason your loan cannot be approved.

Opportunity to request:

-Reconsideration

-Mediation

-Appeal to the National Appeals Division