Land Loan Calculator

Calculate the monthly loan payment on a vacant property by using this Land Loan Calculator.

Calculate Land Loan Payment

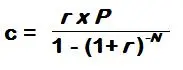

To calculate the monthly payment on a land loan use the formula:

c = Monthly Payment

r = Monthly Interest Rate (in Decimal Form) =

(Yearly Interest Rate/100) / 12

P = Principal Amount on the Loan

N = Total # of Months for the loan ( Years on the loan x 12)

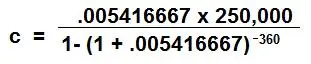

Example: Monthly loan payment for 30 year fixed-rate loan,

with a

principal of $250,000, and a yearly interest rate of 6.5%:

r = (6.5 / 100) / 12 = .005416667

P = 250,000

N = (30 x 12) = 360

The Monthly Loan Payment is $1580.17

Compare Land Loans to A Standard Mortgage

Land loans tend to be scrutinized more by banks and other lenders. They're considered to be more of a risk than a standard mortgage. Typically,

borrowers are much less likely to walk away from a home loan, particularly if the property is being used as a primary residence. With a land loan, it's

easier for a buyer to neglect the property, or stop making payments, since it isn't their primary means of shelter. Plus, a house on a lot has greater

value on the open market, and makes for a more secure form of collateral. Undeveloped land, on the other hand, doesn't deliver the same

degree of investment since it doesn't have any improvements.

These factors make acquiring a land loan a little more difficult than a traditional mortgage. If you have some history with a local bank, or lending institution, it would help

when you're looking to borrow. They'll be able to determine if you're a higher risk to their portfolio and will be more likely to work with you than a national bank.

How Much Can I Afford on a Land Loan?

There are other costs associated with purchasing vacant land that you may want to take into account if you're looking at affordability. In addition to the land loan, take things into account like property taxes or liability insurance on the property. You may also have costs associated with maintenance. Are you buying farm ground with fences for cattle? Are you buying a lot in a city that will need to be mowed on a regular basis? How are you planning to use the land? Are you going to rent it out to farmers or hunters? Is there extra insurance liability with those uses? Are there mineral rights on the property? Are there oil wells on the vacant land? Every property is unique. And every property will have unique needs and costs.